04 Jan Covid-19 Relief Bill-What you need to know

On Dec. 21, 2020, Congress passed the Consolidated Appropriations Act, 2021, containing one of the largest relief packages in history at more than $900 billion. This relief package provides direct payments of up to $600 to individuals, restores the Federal Pandemic Unemployment Compensation at $300 per week, provides additional funding for the Small Business Administration’s Paycheck Protection Program while allowing for certain borrowers to draw a second round of PPP funding, and includes grants for shuttered live venue operators.

The 5,593-page legislation also includes an extension of several provisions of the Coronavirus Aid, Relief and Economic Security Act, including paid sick and family leave credits, the employee retention credit, the airline payroll support program, and more.

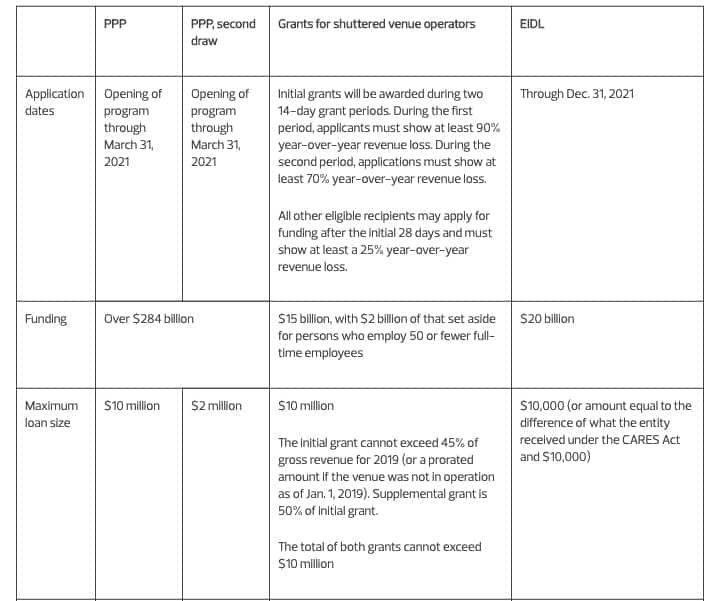

The Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (part of the Consolidated Appropriations Act) includes $284 billion in additional funding for the PPP, $15 billion in grants for shuttered venue operators and $20 billion in new Economic Injury Disaster Loan Assistance (EIDL) grants for eligible entities located in low-income communities.

*Information provided by Chamber member, RSM

Is my business eligible for an initial or second-draw PPP loan?

Which expenses are eligible for PPP loan forgiveness?

What is tax-deductible?

Is there loan forgiveness?

Is my business eligible for EIDL assistance?

Are there grants for shuttered venue operators?

| Thank you RSM!If you have questions about your business and the above information related to the COVID Relief Bill, please contact Chamber member, RSM or nay of our other professionals for assistance.VISIT RSMChamber Member Professional Directory |